Those who rent ultimately pay this expense as part of their rent as it is reflected in their rental price.

Property Tax: this is the local rate home owners are charged to pay for various municipal expenses. Extra payments applied directly to the principal early in the loan term can save many years off the life of the loan. If a home buyer opts for a 30-year loan, most of their early payments will go toward interest on the loan. The 30-year fixed-rate loan is the most common term in the United States, but as the economy has went through more frequent booms & busts this century it can make sense to purchase a smaller home with a 15-year mortgage. Loan Term: the number of years the loan is scheduled to be paid over. For your convenience we also publish current local mortgage rates. This calculator can help home buyers figure out if it makes sense to buy points to lower their rate of interest. If the buyer believes interest rates will fall or plans on moving in a few years then points are a less compelling option. In general discount points are a better value if the borrower intends to live in the home for an extended period of time & they expect interest rates to rise.

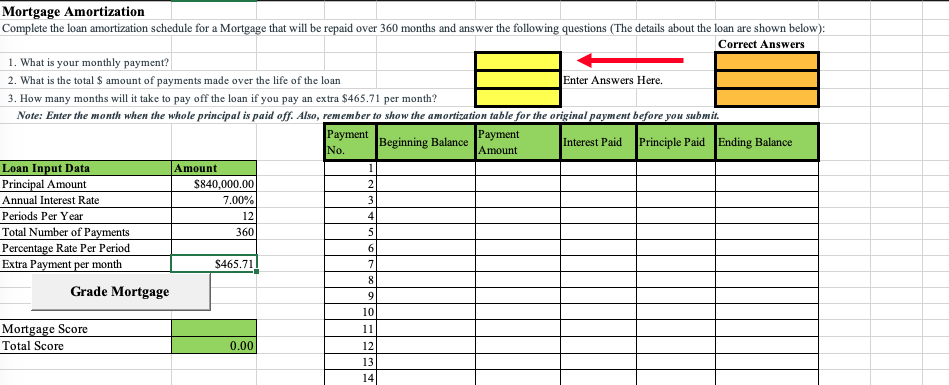

In some cases a borrower may want to pay points to lower the effective interest rate. Interest Rate: this is the quoted APR a bank charges the borrower. If the loan amount is above 80% of the appraisal then PMI is required until the loan is paid off enough to where the Loan-to-value (LTV) is below 80%. Loan Amount: the amount a borrower is borrowing against the home. This is used in part to determine if property mortgage insurance (PMI) is needed. In addition, you’ll receive an in-depth schedule that describes how much you’ll pay towards principal and interest each month and how much outstanding principal balance you’ll have each month during the life of the loan.Home Value: the appraised value of a home. The calculator will tell you what your monthly payment will be and how much you’ll pay in interest over the life of the loan. You can also add extra monthly payments if you anticipate adding extra payments during the life of the loan. To use the calculator, input your mortgage amount, your mortgage term (in months or years), and your interest rate.

Amortized mortgage full#

Determine how much extra you would need to pay every month to repay the full mortgage in, say, 22 years instead of 30 years.Determine how much principal you owe now, or will owe at a future date.This means you can use the mortgage amortization calculator to: How much time you will chop off the end of the mortgage by making one or more extra payments.How much principal you owe on the mortgage at a specified date.How much total principal and interest have been paid at a specified date.How much principal and interest are paid in any particular payment.How do you calculate amortization?Īn amortization schedule calculator shows: A portion of each payment is applied toward the principal balance and interest, and the mortgage loan amortization schedule details how much will go toward each component of your mortgage payment. The loan amortization schedule will show as the term of your loan progresses, a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of your term.Ī mortgage amortization schedule is a table that lists each regular payment on a mortgage over time. Initially, most of your payment goes toward the interest rather than the principal.

The downside is that you’ll spend more on interest and will need more time to reduce the principal balance, so you will build equity in your home more slowly. With a longer amortization period, your monthly payment will be lower, since there’s more time to repay. Over the course of the loan, you’ll start to have a higher percentage of the payment going towards the principal and a lower percentage of the payment going towards interest. If you take out a fixed-rate mortgage, you’ll repay the loan in equal installments, but nonetheless, the amount that goes towards the principal and the amount that goes towards interest will differ each time you make a payment. Over the course of the loan term, the portion that you pay towards principal and interest will vary according to an amortization schedule.

Amortized mortgage plus#

Each month, your mortgage payment goes towards paying off the amount you borrowed, plus interest, in addition to homeowners insurance and property taxes.

0 kommentar(er)

0 kommentar(er)